CBRS is rapidly gaining fans as enterprises find its mid-band location provides them with the capacity and coverage they need for their desired applications. Its innovative sharing mechanism allows businesses to use purchased licenses or, in many areas, use it free of charge – a significant advantage over public networks.

One of the more recent use cases put in practice with the 3.5 MHz Innovation Band is the CBRS-based Neutral Host Network (NHN).

Neutral host networks are the Swiss Army knife of wireless infrastructure. They’re built to give several different wireless companies, as well as users, a way to connect easily. These networks have typically been deployed in office buildings, where hundreds of people come together on a regular basis, using different mobile network operators (MNO). Multiple MNOs can share the same network infrastructure, providing coverage to their subscribers in buildings where macro networks have trouble reaching. NHNs are a win-win for both businesses and the people who use their wireless services. However, they can be costly to deploy and difficult to scale using existing approaches like Distributed Antenna System (DAS). An alternative is NHN using neutral CBRS spectrum.

A recent panel discussion hosted by the OnGo Alliance titled “CBRS Neutral Host Solutions: Revolutionizing Indoor Cellular Coverage for Mid-Sized Enterprises and Venues” was led by Ed Pichon, the CTO at E-Qualus Partners and an OnGo Alliance Business Working Group member, acting as host and moderator.

The panelists included:

- Santhosh Hosdurg, Director of Technology for the Cisco Provider Mobility Group

- Rob Cerbone, VP of Product Management and Marketing for CTS

- Jonathan Polly, Digital Transformation Advisor and 5G Program Manager at Cal Poly, San Obispo

- Kyung Man, Principal Analyst for Mobile Experts

- Joel Lindholm, CEO and Co-founder of InfiniG

The panelists brought out several significant points.

- MOCN is the way forward

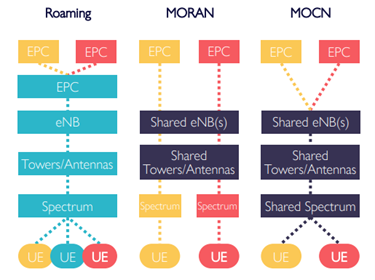

There are essentially three architectural options to consider when discussing Neutral Host Networks: Roaming, Multiple-Operator Radio Access Network (MORAN), and Multiple-Operator Core Network (MOCN).

Source: OnGo Neutral Host Network Deployment Guide

The consensus was that the MOCN option is currently the most successful and the most likely to move forward in large numbers.

- Think beyond office buildings

A second note was that CBRS-based NHNs will likely not be limited to office buildings. It was suggested that the user base will be broader than previously expected. Cerbone said, “The verticals that we’re seeing are really anyone that has a significant amount of either tenant traffic or foot traffic.” These will consist of education, factory floors, hotels, casinos, convention centers, and healthcare, as will any place where customer satisfaction and service differentiation are significant. The time has arrived when sufficient indoor wireless coverage can be provided at an affordable price point.

- It’s essential to keep the KPIs consistent

A third point brought out by the panel was the need for operators to keep their KPIs consistent. Hosdurg noted, “The carriers often strive to have the same KPI numbers because you can’t have X outside and Y inside.” KPIs serve as the yardstick by which the network’s performance, efficiency, and reliability are measured over time, and in the case of an NHN, where multiple mobile service providers share infrastructure, consistency in KPIs ensures equitable access and satisfaction for all stakeholders involved.

An associated point with the KPIs is the regulatory responsibility that lies with the carriers. If a 911 call doesn’t go through, that’s on the carrier. They must ensure that the proper public safety answering point (PSAP) is always notified, as it could be a case of life and death. [A PSAP is a call center where emergency and non-emergency calls are routed for fire, police, etc.] Polly, who works at California State Polytechnic University, which has deployed a CBRS-based private network, noted that it took 3-4 months to get their network working properly with 911 services.

- The deployment architecture depends on the use case

A fourth observation concerned the core part of the private network – should it be on-site or in the cloud? The agreement was that it could go either way, depending on the requirements and use cases, and that it might need to migrate over time. For example, a business might want to start with it in the cloud, but as applications arise that need better data security or run with lower latency, it might be necessary to move the core on-site. In some cases, scalability is a primary concern, as with large venues that hold sporting events for a few hours or a college campus during graduation week. Either way will see massive increases in data traffic for limited periods of time.

A few other notes of interest:

- Mun forecasts a 20% CAGR over the next five years for NHNs, with much of the growth seen in smaller buildings

- Companies find that using a CBRS-based private network in conjunction with a CBRS-based NHN is a good return on infrastructure investment.

- NHNs, along with private networks, DAS, and Wi-Fi, should all be considered tools.

- Enterprises that think adding an NHN will be revenue-generating will find that to be the exception, not the rule.

To learn more about CBRS-based Neutral Host Networks, please see the OnGo Neutral Host Network Deployment Guide and the OnGo Neutral Host Business Update.